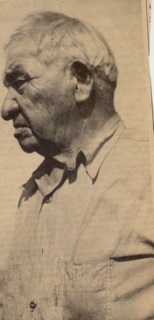

Downey Harvey gives the Ocean Shore RR thumbs UP.

Story from John Vonderlin

Email John ([email protected])

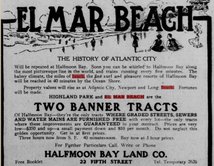

This is from a five column advertisement in the April 19th, 1908 issue of “The Call.” This plea for citizen investment in their troubled company, tells a quite complete story of the company at this point in time. It also gives a slice of “Who’s Who” in the turn of the Century business circles of San Francisco. Perhaps, because I know how this turns out, I’m a bit cynical, but, explaining what bonds are in a newspaper ad, to the people you’re trying to sell them to, seems like a poor strategy, and reeks of desperateness. Enjoy. John

NOTE—-This announcement of the Ocean Shore is printed here for you to read. You can read this announcement with my positive assurance that every statement is bona flded and the officers of the Ocean Shore can and will substantiate them.

J. DOWNEY HARVEY

Pres. Ocean Shore Ry. Co.

Why is the Ocean Shore

selling bonds direct to the

people?

If the people own the bonds of the

Ocean Shore, they will be friends of the

road, and their confluence will be a big

factor in its favor. The rich and luxury

loving classes have been the bond buy-

ers of other roads; only a small percent-

age of the people have ever been given

a chance to buy bonds. Bonds are the

cream of all investments and are usual-

ly issued in denominations of $1,000

each, which enabled only the financiers

and bankers to buy such securities.

The usual plan for selling bonds was

to place the entire issue in the hands

of a group of bankers who were called

an underwriting syndicate. These men

agreed to take and pay for the entire

issuance of bonds at a price below their

par value. The syndicate then sold the

bonds to the public at an advanced rate,

keeping the difference for their profit.

The Ocean Shore bonds are sold by

the Ocean Shore Railway Co. direct to

the public and all the money received

from the sale of the bonds is used to

complete the railroad between San Fran-

cisco and Santa Cruz.

Why are Ocean Shore bonds

issued in denominations of

$100 instead of $1,000 each?

The general public as a rule cannot

afford to buy $1,000 bonds. Ocean

Shore bonds are issued in denom-

inations of $100 each to give every

person with at least $100 an op-

portunity to invest in these bonds and

get a class of security which has hereto-

fore been sold only to the rich. The

Ocean Shore prefers to have a great

many bond holders than a very few. .

The more bond holders the more

friends and patrons the road will have.

Why are Ocean Shore bonds

sold for $92 and $96— or below

their face value?

When times are hard and money scarce

it is necessary to make even sound in-

vestments attractive and profitable. The

Ocean Shore offers every bond buyer

a $100 bond for $92 cash. Interest rates

are high now, and when 5 per cent $100

bonds are sold at $92 the bond holder

receives 5.43 per cent interest on his

money. This higher rate of interest on

railway bonds is an inducement for in-

vestors to buy Ocean Shore bonds in

preference to other bonds.

The Ocean Shore needs money to

complete its railroad and must sell bonds

to get this money. Other railroads have

sold their bonds in favorable times when

31/2 and 4 per cent were considered high

interest rates.

Why are Ocean Shore bonds

the best investment for Caliifornians?

Ocean Shore bonds pay a higher rate

of interest— higher than most bonds

and they are an absolutely safe invest-

ment. The bonds are secured by a

$5,000,000 mortgage on the entire assets

of the railroad, which are valued at over

$9,000,000. This mortgage is held in

trust for the bond holders by the Mercan-

tile Trust Co. of San Francisco, who rep-

resents the bond holders.

The Ocean Shore is a California en-

terprise — it is the beginning of a great

railway system and the building up of

San Francisco by developing a very fer-

tile and naturally resourceful country

between San Francisco and Santa Cruz.

This railway will help to develop Cal-

ifornia, and in doing so, will add to the

material advancement of the state— and

increase business in all lines, giving em-

ployment to many men supporting fam-

ilies.

The Ocean Shore will increase property

values and everybody will be benefited,

and that is why Californians should in-

vest in Ocean Shore bonds.

Why is it necessary for the

Ocean Shore to sell bonds?

No railway is built without selling

bonds, The cost of railway building is

too expensive for any man or set of men

to finance without sellirig;bonds.

The owners of the Ocean Shore have

invested $3,000,000 of their own money;

and require more to complete the work,

they offer bonds to the public. When

a railroad requires more cash to buy

what they need it is not practical to se-

cure a loan from a bank or from an in-

dividual, so they issue bonds, which are

a part of a mortgage, and sell small parts

of a big mortgage to a great many people.

In other words, the bond buyer, loans

the road money, taking; as evidence of his

security a bond, and this bond is secured

by a first mortgage held by a trustee for

the bond holders.

Suppose the railway fails or is not

efficiently managed, what happens to

the bond holders?

If you are a stock holder in a railway

and it fails; you lose your money or a

part of it, because you are one of the.

owners; but as a bond holder you cannot

lose, because you can fall back on the first

mortgage, and the railroad with all its

property is yours. You, as a bond holder

are, “a preferred creditor” and the stock

holders are responsible to you.

Buying stock is risky, for it is a busi-

ness venture, but buying bonds is an in-

vestment which cannot be assessed or

taxed or made liable in any possible way.

Can the Ocean Shore earn

enough money to pay the in-

terest on its bonds?

Yes, and eight times more than enough.

The Ocean Shore has its depot at 11th

and 12th and . Mission and Market streets,

quite accessible to the local carlines and

homes of San Francisco. It has terminal

property in the hearts of the business

section of Santa Cruz, making this line

very convenient to passengers.

The railroad itself runs along, the

ocean for 70 miles, and is the grandest

scenic route in the world. The road

runs through very fertile land upon

which there is produced 1,200 carloads

of cabbage and 400 carloads of arti-

chokes every year. There are a great

many vegetable gardens, orchards, dairies,

lumber mills,bitumin quarries, lime

and paving rock quarries, besides 1 ,500,-

000,000 feet of the finest redwood timber

in the world. .

There are seven tanneries on the line

of the Ocean Shore, and these tanneries

will use enormous quantities of tan bark,

which can be hauled from the forests on

the Ocean Shore direct to these tan-

neries.

There are also many deposits of ce-

ment and building sand along the line.

Freight arrangements have already

been made with two concerns which will

net the Ocean Shore $200,000 a year.

Railway experts figure the possible

earnings of the Ocean Shore at over

$2,000,000 a year, while the bond interest

only amounts to $250,000 a year.

What do the assets of the

Ocean Shore consist of?

These assets, valued at $9,000,000, con-

sist of valuable terminal facilities in San

Francisco and Santa Cruz with a real

estate value of over $2,000,000; rights

of way, track privileges, railroad tracks,

lands, equipment and privileges. The

terminal facilities in San Francisco have

a value far in excess of the total

amount of bonds issued. This property is

rapidly increasing in value and will soon be

regarded as inestimable, for it is very likely

that a large union depot will be built at 11th

and 12th and Mission and Market streets,

and all the railroads entering San Francisco

will meet at this common center, giving San

Francisco the largest union depot in the state.

What are the present earn-

ings of the Ocean Shore?

During the month of March, the Ocean

Shore earned over $7,000 from its train

service between San Francisco and San

Pedro, and over $l,500 from its line be-

tween Santa Cruz and Scott Creek. The

latter showing is very low because lumber

mills at Scott Creek were closed and

usual shipments deferred.

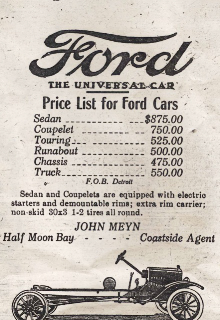

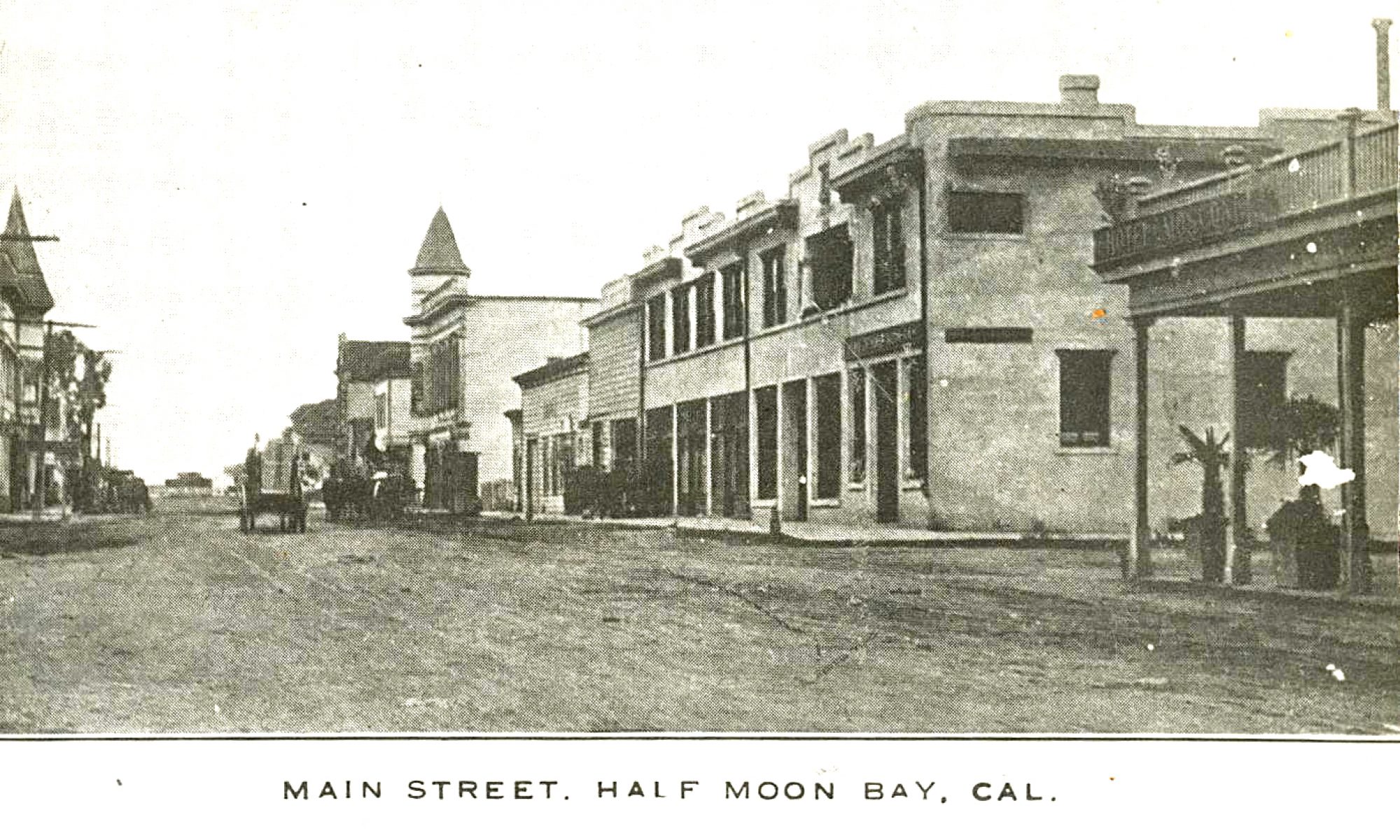

The earnings of the Ocean Shore will

be greatly increased as soon as the road

reaches Half Moon Bay, and more cars

can be secured. At the present time the

equipment is inadequate and hundreds

of people are turned back every Sunday

because there are not cars enough to

accornmodate all who desire to patronize

the lirie. New cars have been ordered; and

when they are put into use the company

can accommodate freight and patrons and

earn several thousand dollars a month more.

When will the Ocean Shore

be entirely completed?

The Ocean Shore is more than half

completed. The track is laid and in op-

eration between San Francisco and Far-

allone City, 24 miles, and also between

Santa Cruz and Scott Creek, 16 miles.

Over 85, per cent of the .grading is fin-

ished between Farallone City and Scott

Creek.

Over 400 men have been at work

since January 15th. Three steam shovels

are also working night and day. The

work is going ahead as rapidly as possible

with a limited supply of money. At the

present rate of bond sales the road will

reach Half Moon Bay by July 1 and

Santa Cruz by January 1. When through

to Santa Cruz and money is available

the Ocean Shore will be electrified and

double tracked.

How much money is re-

quired to entirely complete

the road?

$2,500,000 more will complete this

road in accordance with the plans. The

company, will run high power electric cars

from San Francisco to Santa Cruz in

21/2 hours. Such a service will attract

many thousands of passengers, who will

patronize this line on account of the ex-

cellency of the service offered and be-

cause of the attractive features and re-

sorts along the route.

How many bonds have been

sold? Who are buying Ocean

Shore bonds?

The total issue of bonds amounts to

$5,000,000, of which $2,250,000 has been

sold and the money spent on the road

and equipment.

There are $2,750,000 bonds to be sold.

Ocean Shore bonds have been purchased

by several hundred of the enterprising,

progressive citizens of California. Many

of the large bond holders are men of

prominence in business and banking cir-

cles. Many of these bond holders are

large property owners of San Francisco

and Santa Cruz. Many are banks and

some are held by. estates and insurance

companies. Hundreds are held by men

and women of moderate means.

The following is a small list of bond

holders, any one of whon you may ask

about Ocean Shore bonds.

Rev. Fr. Crowley. Youths’ Directory, Harry Stetson,

Director of Metropolitan Trust and Savings Bank,

Reuben H. Lloyd. Henry Epstein, Walter S. Martin,

Pres., Oregon Land Co., John I. Sabin Estate, Late

Pres. Pac. Tel. Co., J. R. Stetson, Pres., Calif.

Street Railway Co., L. Bocarequez, Pres. French-

Amercan Bank, Herman Shainwald, Pres. Shainwald

and Buckbee Co., Peter D. Martin, Vice Pres., Eastern

Oregon Land Co., S. G. & S. C. Buckbee. Shainwald,

Buckbee & Co., Wm. Berg, Wm. Berg & Co., Grain,

C. C. Moore, Pres., C. C. Moore & Co., engineers,

Thomas Magee, Pres., Thos. Magee & Sons., Peter F.

Dunne, Gen’l Atty., So. Pac. Co., J. J. Mack. Pres.,

Imperial Oil Co., A. Mackie, Supt. S. F. Relief and Red

Cross Funds, J. A. Folger, Pres., J. A. Folger Co., L.

Guggenhime, Pres., Thirty-three Oil Co., E.S. Pillsbury,

Pillsbury, Madison & Sutro; Director Mercantile Trust Co.,

A. W. Haas, Haas Bros., Wholesale Grocers., H. D.

Pillsbury, Pillsbury, Madison & Sutro, Atty, A, T, & Santa

Fe, Richard Oxnard, Pres., Western Sugar Refinery, C. E.

Lilly, Director, People’s Bank of Santa Cruz, Alexander

Hamilton, Vice Pres., Baker & Hamilton, W.E. Dean, Pres.,

California Insurance Co., Thos. McClay, Wickersham Bank,

Petaluma, B. Schweitzer, Hoffman, Rothchild & Co.,

People’s Bank of Santa Cruz, Fireman’s Fund Ins. Co,

and Bank of Santa Cruz County.

How can I satisfy myself

that your statements are true?

The books of .the Ocean Shore Rail- :

way Co. are open to every reasonable

man who wishes to examine them. The

Ocean Shore has nothing to conceal from

any one. The stock holders have paid

real money for their stock and the head

officers are serving without salary.

All of the officers and employes are

willing, to give you detailed information

about the railway. There is every possi-

ble opportunity for you to satisfy your-

self .that the Ocean Shore is honorable,

upright and an honest organization

which has invested every dollar received

from the stock holders and the bond hold-

ers economically and honestly.

Who are the directors and

officers of the Ocean Shore?

J. Downey Harvey, the president, is

connected with many of the larger finan-

cial interests of the coast and is a direc-

tor in two of the largest banking houses

of the c\ty of San Francisco, viz : the

First National Bank and First Federal

Trust Company.

Mr. J. A. Folger. First Vice President,,

is the president of J. A. Folger & Co.,

one of the largest and oldest mercantile

enterprises on the Pacific coast. Mr.

Folger is known as a conservative and

shrewd business man, and his long and

successful career should recommend him

to all for conservatism and good judg-

ment.

Mr/ Horace D. Pillsbury of the legal

firm of Pillsbury, Madison & Sutro is

Second Vice President. Mr. Pillsbury is

one of the prominent attorneys of the

state and a leading member of the bar

of Sa/i Francisco. He is the attorney

for the Atchison, Topeka and Santa Fe

railroad and is prominent in other large

enterprises.

Mr. Peter D. Martin, Director. Mr.

Martin is a member of one of the oldest

and best known pioneer families of Cali-

fornia. He is connected with many large

interests in California and Oregon and

is vice president of the Eastern, Oregon

Land Co. He has large property inter-

ests in San ‘Francisco.

Director Charles C. Moore is president

of C. C. Moore & Co., engineers, one of

the largest engineering concerns in the

west. Mr. Moore is probably one of the

best known men on the Pacific coast, as

he is at the head of the. pioneer designing,

constructing and engineering concern of

the» Pacific coast, with branches at New

York, Seattle, Salt Lake’ City and Los

Angeles.

Mr. Burke Corbet is general counsel

and secretary. Mr. Corbet is one of the

prominent members of the bar of the

city of San Francisco and is well known

to most residents of this city and state.

What assurance have I that

my money is safe and my in-

terest secure?

Your money, when invested in Ocean

Shore bonds, will be expended on the

railway — it will help to increase the

value of the road and give added secur-

ity to the bond holders, of which you will

be one. You will be associated with

prominent men of San Francisco who

have a reputation for their business hon-

esty and integrity.

You will be a bond holder in a great

railway system which will have a splen-

did future and be of great value to San

Francisco and California. Your money

will be secured by the $5,000,000 mort-

gage on our $9,000,000 of assets.

Your interests in the railway will be

as carefully watched as the interests ot

the officers and directors. And in. addi-

tion to securing a high rate of interest on

your investment, you will be helping an

enterprise which will in turn be a help

to you.

On what terms are Ocean

Shore bonds sold?

$100 Ocean Shore bonds are sold for

$92 cash, or $96 on easy payments— $l6

down and $10 a month for eight months.

At the end of eight months you get $2.50

interest on your installment payments,

which practically reduces the cost of

your bond to $93.50.

When the road is completed these

bonds you buy for $92 and $96 will sell

in the open market for $110 and $120 and

in the meantime pay you 5.43 per cent

and 5.21 per cent on your investment.

Can I go over the road and

see for myself what you have?

You certainly can. If you are inter-

ested and every true loyal Californian

should be, please call at the office of the

president, who will tell you everything

you want to know, and when he has

given you complete information he will

give you a pass, which will entitle you

to all. the courtesies of the train crew,

and you can go over this most magnifi-

cent scenic/route and see exactly what

the Ocean Shore has done and how well

the work has been done.

You will be treated courteously, po-

litely and be entertained as any good man

or woman should be — and when you are

through with your examination you are

free to invest or not, as you choose, with-

out being under any obligation what-

ever, to buy Ocean Shore bonds.

Booklets sent on request.

———————————–

From Angelo Mithos

Thanks, John, for the attachments. Yes, a good example of the desperate straits the OS was in. Listed in a 5/14/09 S.F. Call “Legal Notices” column are the names of stock holders who’d forfeited their shares for failure to pay the $5 levy per share the OS had assessed. Among them is H.D. Pillsbury, which name appears among the

references for prospective Ocean Shore bond buyers in your attachment. It was really sad in a way. Ironically. under an adjoining column, same page (P. 13), under “Investments,” individuals and firms are offering OS bonds for sale at reduced prices, described by one as “…an absolute safe, splendid investment, free from risk”–and yields described variously as from 4 to 8%. A lot of trusting small people besides the big guys got stung by the OS. Angelo

Andres Osorio: Did the last Costanoan live and die in Half Moon Bay?

Andres Osorio: Did the last Costanoan live and die in Half Moon Bay?